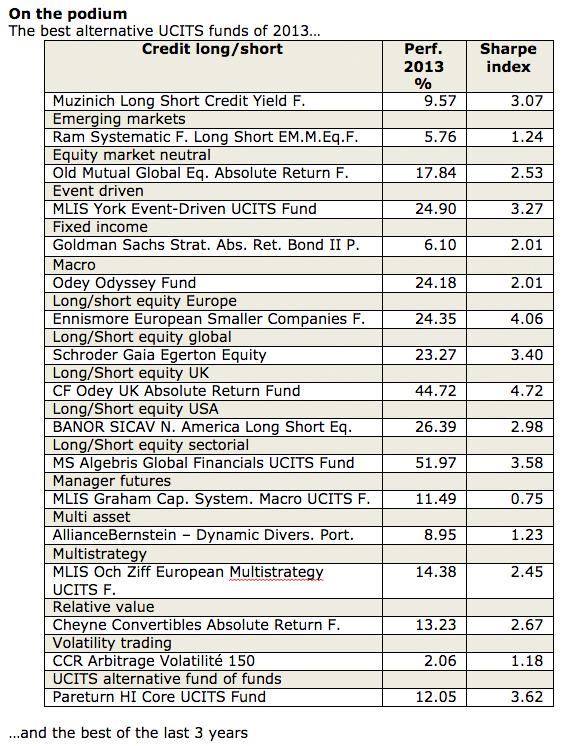

Banor Capital Ltd is proud to announce that Banor Sicav North America Long Short Equity is the winner of Mondoalternative Awards 2014 in the category Best Alternative UCITS Fund 2013 – Long Short Equity USA.

Read the full article below.

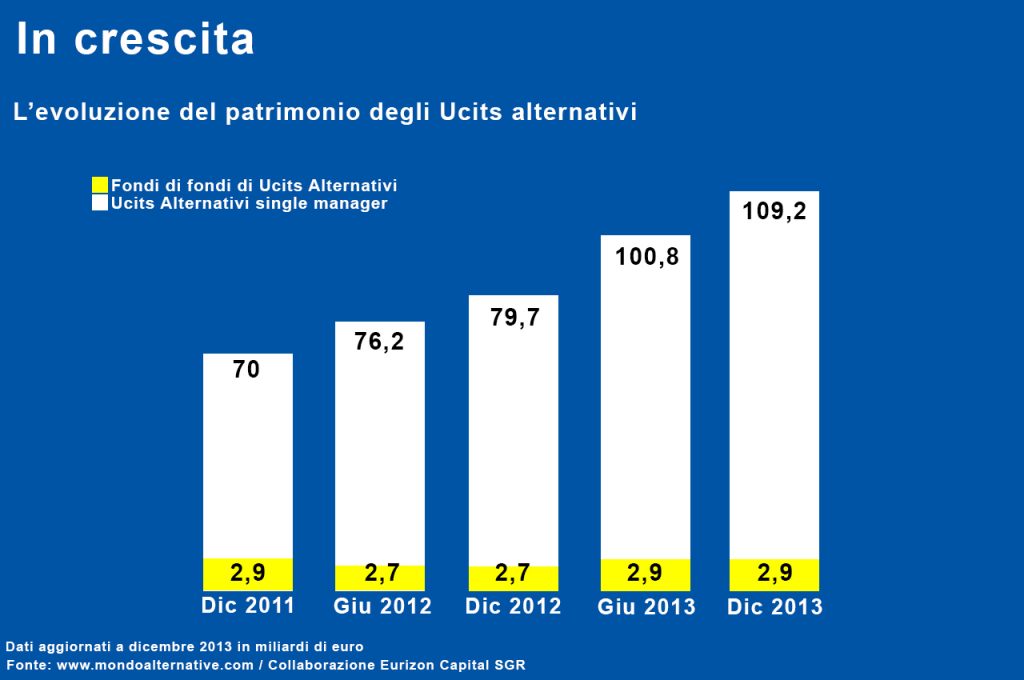

Trends. In 2013 single manager UCITS portfolios grew by 37%

Forecasts. After the records set, can managers maintain the performance?

An ability to avoid excessive fluctuation is one of the most valued characteristics of funds that don’t follow the traditional markets.

By PIERMILIO GADDA

Alternative funds are taking off again after a record year. 2013 closed at the global level with total assets estimated at 109 billion euro for single manager UCITS funds, up 37% on an annual basis. Alternative UNITS funds of funds were stable, rising from 2.7 to 2.9 billion. The funds monitored by MondoAlternative show net funding of 18.5 billion euro in 2013: in detail, the share category represented by long/short equity (7 billion) and equity market neutral (1.8 billion) funds surpassed fixed income products (8.7 billion). It is no surprise that strategies focusing on equity attracted greater consensus, especially in the second part of the year, which was marked by fears of a rate rise and the collateral effects of tapering (reduction of the monetary stimulus) on bonds. Long/short credit (3 billion euro) and multi-strategy funds (2.2 billion) also saw significant flows.

Returns

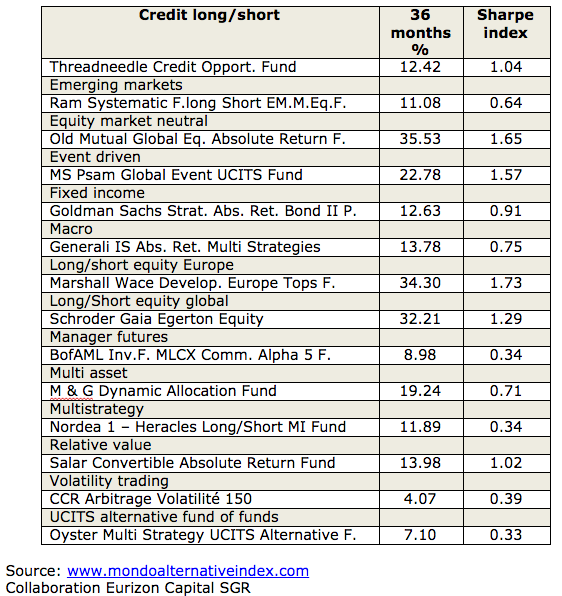

Overall, the flow data seems to be reflected in performance. The MA-Eurizon UNITS Alternative Long/Short Equity fund heads the ranking for most profitable strategies of 2013, with a performance of 12.5%. Admittedly, that may not seem much in a year that saw the S&P yield just under 30%.

But it is appreciable if we consider that the principle American list was two and a half times more volatile. Contrary to the negative assumption that they are subject to severe fibrillation, all the alternative strategies maintained relatively low levels of volatility in 2013: between the 0.87% of the market neutral funds (through a balancing of long and short positions, they neutralise market risk and reward the choice of the best stocks) and the 5.6% of the MA-Eurizon UCITS Alternative Managed Futures index. On paper, the share categories could outperform again in 2014.

But after last year’s rally, the probability of lateral movements or possible adjustments has increased. And for alternative funds too, the situation is becoming more complicated. Matteo Santoro, head of the New York office of Kairos Partners, is convinced that in the presence of greater yield volatility and dispersion, long/short equity strategies could be even more attractive during 2014, thanks to their ability to generate profits by taking both rising (long) and falling (short) positions.

Neutrality

Francesco Marini Clarelli, CEO of Astor SIM, a company delegated to manage the alternative funds of Symphonia SGR, suggests market neutral strategies. “Many long/short equity funds tend to show an imbalance towards long positions: it’s better to be covered”. And let’s not forget event-driven strategies, which focus on stocks subject to extraordinary finance operations such as spin-offs, restructuring, and mergers and acquisitions, and are set to regain ground in a context of progressive lessening of systemic risks and the absence of sustained growth by the principal world economies. “We expect them to do well in 2014 too, thanks not least to the resumption of M&A operations in Europe, especially in sectors like telecoms”, observes Andrea Floccuzio, head of Morgan Stanley’s Fundlogic Alternatives platform. Another interesting sector, in the view of Marco Covelli, direct investment director of Ersel, will be banking.

Key to “In crescita” (“Growing”) table

L’evoluzione del patrimonio degli UCITS alternativi = alternative UCITS funds over time

Fondi di fondi UCITS Alternativi = alternative UCITS funds of funds

UCITS Alternativi single manager

Dic = December

Giu = June

Dati aggiornati a dicembre 2013 in miliardi di euro = Data up-dated to December 2013 in billions of euro

Fonte: www.mondoalternative.com = Source: www.mondoalternative.com

Collaborazione Eurizon Capital SGR = Collaboration Eurizon Capital SGR

The contents provided for in this section have not been audited by independent bodies. There’s no warranties, expressed or implied, regarding reliability, accuracy or completeness of the information and opinions contained. The informations provided are not based on assessment of the adequacy and do not consider the risk profile of the possible recipients, and therefore, should not be construed as personal recommendation and does not constitute investment advice. The contents of this site may not be reproduced and/or published whole or in part, for any purpose, and/or disclosed to third parties.