Il Sole 24 Ore PLUS supplement interviews Dawid Krige – Advisor Banor SICAV, Greater China Long Short fund – on the chinese market’s future perspectives and on investment strategy in Asia.

Read the full article below.

“We’re placing strong bets on Kweichow Moutai”

A leading company in the Chinese drinks sector, stocks priced low and with great potential

By Isabella Della Valle

You’re an Asia specialist. How will the Fed’s change of policy affect the region?

We expect the Fed will gradually launch a restrictive monetary policy over the next few years. Historically, emerging countries with budget deficits, such as India and Indonesia, are vulnerable to rising tax scenarios. However, we’re concentrating on “Greater China” (China, Hong Kong and Taiwan), and for that region the impact of higher taxes in the USA will be minimal. China’s recent monetary policy has been anti-cyclical. While most of the world will see restrictive monetary policies in the next 2-3 years, in China we’ll be seeing a relaxation.

Why should investors place their bets on Greater China?

The appeal of investing in the Chinese macro-region is simple: attractive evaluations, higher-than-average growth outlook, inefficient markets with scope for alpha generators.

But are the evaluations still good value?Yes, China is still cheaper than the main global stock markets. The market deals at 9 times profits compared with 18 for the S&P 500, 21 for the Nikkei and 22 for Euro Stoxx. Dividends for Chinese stocks listed in Hong Kong give an average yield of 5% and securities are trading at a price to book ratio (P/BV) of 1, the lowest level in the last 10 years.

The area has excellent growth prospects. China is the world’s second largest economy, even though it’s still a poor country in many respects. GDP per head is about 7,000 dollars compared with 50,000 in the USA. We expect GDP growth to slow to around 5-7% over the next decade and China to become the world’s leading economy in the next 15-20 years. And many sectors and companies are growing at rates well above 7%.

You mentioned inefficiency earlier. What did you mean? Retail investors account for a high proportion of daily volumes (80%); shares are held, on average, for just 4 months. Research analysts’ coverage of the small cap segment is very patchy (49% of shares aren’t covered, compared with 14% in the UK market). All of this creates inefficiencies that can be exploited by investors adopting a fundamental approach, like us.

But the Chinese market is complex. What strategy are you following? We define our strategy as “quality value”. Briefly, we try to buy high quality companies at a discounted price.

What do you mean by quality? Having a lasting competitive advantage, and a competent and honest management team that treats its shareholders well. The number of companies like that in China is low: our investable universe consists of about 150 stocks, as against 5000 present on the market. Of those companies, we hold 20-30 names – the most under-valued with respect to our growth projections for the next 4 years.

Chinese companies’ financial statements have never been paragons of transparency. What’s the situation like today? Financial communication has improved, but investors still need to be careful: we regularly come across false accounts. Companies in this region usually have one absolute majority shareholder (the state, or a private individual). Changes in the governance system are very slow. There are no “activist” investors in these parts.

What criteria do you follow to select companies? Fundamental analysis. We take about a month to build an assessment model. We have an office in Shenzhen, in China, which enables us to conduct on-the-spot checks and visits. Over the last 10 years our strategy has brought excellent results, thanks to our disciplined approach and our obsession with cash flow compared with announced earnings.

How are you positioned in terms of sectors? The fund has a major exposure towards 3 sectors: media and Internet, luxury goods, and travel and leisure. China has some very high level companies in those 3 sectors and we’ve identified some with very attractive evaluations. From a geographical perspective we’re finding better value in China that in Taiwan.

What companies are you betting on? In first place is the leading Chinese drinks company, Kweichow Moutai, which owns a brand with a 300-year history. Like many other luxury goods stocks, this one was hit by the government’s crack-down on corruption. In our view, this impact will be short-lived. It has enabled us to buy this extraordinary company at 8 times profits with a dividend of 5%. The same government policy hit many companies linked to Macau. Emperor Entertainment Hotel is trading at 6 times earnings with a dividend of 5%. The cash value and the value of the two hotels owned by the company exceeds the market capitalisation. So at today’s value the gambling and casino business – highly lucrative – has a zero evaluation.

Unlike Italy, China does not have many extraordinary companies, although the internet sector has some very good ones. We have some of these in our portfolio, including Baidu, the “Chinese Google”. The search engine sector tends to produce monopolists, as a result of the “network” effects and the economies of scale. We bought Baidu 2 years ago, after the price lost 40% in the wake of problems that we deemed to be temporary. Since then, the stock has almost tripled. We’re also investing in non-Chinese companies which have a major exposure to the region. At the moment we have 2 American companies in our portfolio, one of which is Yahoo!. Because it offers investors a greater margin of security, along with an important long-term investment in Alibaba, China’s main e-commerce company.

Dawid Krige is an advisor with Banor Capital Ltd, an independent company under UK Law and a subsidiary of Banor SIM (formerly Banknord), for the Banor Greater China Long Short fund.

Dawid has more than 10 years of investment experience in Asian equities. From 2005-2011 he was a portfolio manager with Mondrian Investment Partners focusing on emerging market equities. In addition to his portfolio management duties, he had primary research responsibility for China. Before that he was an Asian stocks analyst with RMB MultiManagers. David studied at the London Business School, where he obtained a Masters in Finance, and has an honours degree in Economics from Stellenbosch University. He obtained the CFA charter in 2004.

A firm with the focus on total return

With 3.5 billion euro and over 1000 clients under direct management, Banor Sim (formerly Banknord) is an independent Italian firm specialising in asset management and investment advice. Banor has offices in Milan and Turin. It also has a London base, after acquiring a stake in Banor Capital Ltd, the asset management company owned by BANOR SICAV, the Luxembourg-based Ucits IV harmonised investment company. In March 2014 BANOR obtained Global International Performance Standards (GIPS) certification. Based on the Value Investing model, its philosophy is focused on total return.

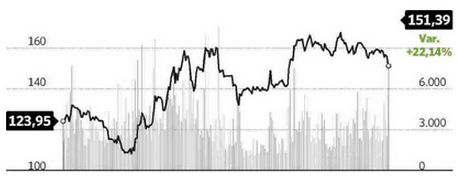

KWEICHOW MOUTAI

Volumes and performance

Shanghai Stock Exchange

China’s Kweichow Moutai has lost ground after breaking through, at around 155, the line that had been rising since the lows at the start of the year. Support at 140 Yuan is strategic, not just in the short-term. If prices fell below that level, the possibility of bottoming out at 118, as seen at the start of the year, would increase and the long-term outlook would again give cause for concern.

In recent months the attempt to climb from the aforementioned lows has come up against the 100-week moving average, at present sticking at around 165, which also held it down in April. Only if it overcomes this resistance would the downwards trend under way since 2012 be reversed. This would create the conditions for rises which, once past the 180 mark, would see the way clear to 205/210 and 230 Yuan. (From FTA Online).

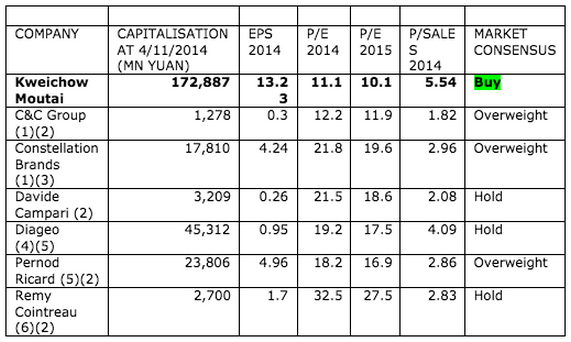

Comparable stocks

EPS = earnings per share; P/E = price/earnings; P/SALES = price/sales

(1) end of financial years 28/2/2015 and 2016; (2) figures in euro; (3) figures in $; (4) figures in £; (5) end of financial years 30/6/2015 and 2016; (6) end of financial years 30/3/2015 and 2016

SOURCE: Financial market analyses from Factset figures

Chinese group Kweichow Moutai is the world’s biggest producer of China’s national liqueur, also known in the West as Moutai. The group produces about 20,000 tons of liqueur per year, with exports going to over 100 countries, including the United States. As there are no other listed Chinese companies in the spirits sector, for information purposes a sample of the main global producers was selected. With respect to the companies included in the sample, Kweichow Moutai has lower estimated P/E multiples for 2014 and 2015, but the situation is reversed if we consider the P/Sales multiple for 2014.

The contents provided for in this section have not been audited by independent bodies. There’s no warranties, expressed or implied, regarding reliability, accuracy or completeness of the information and opinions contained. The informations provided are not based on assessment of the adequacy and do not consider the risk profile of the possible recipients, and therefore, should not be construed as personal recommendation and does not constitute investment advice. The contents of this site may not be reproduced and/or published whole or in part, for any purpose, and/or disclosed to third parties.